Overview

The Coronavirus Aid, Relief and Economic Security (CARES) Act, signed into law on March 27, 2020, is the largest economic recovery package passed by Congress in American history. This new law provides employers with a range of federal loan and financial assistance options, backed by the Small Business Administration and U.S. Treasury Department, to help maintain payrolls and cover other operating expenses during this national emergency.

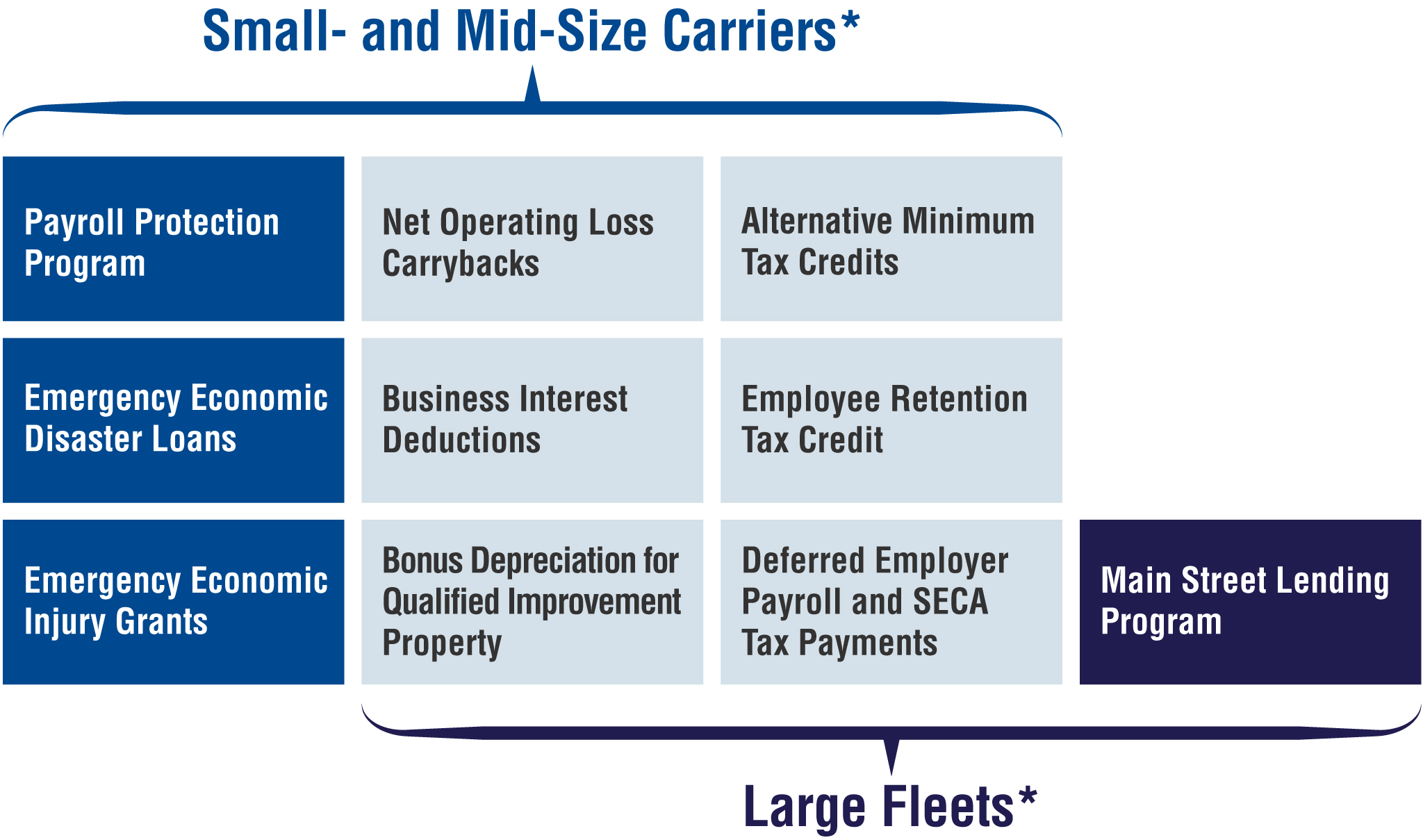

*More information on SBA employer-size standards and program eligibility below.

Business Loans

Various lending programs are available depending on size of the business:

- The Paycheck Protection Program and other Small Business Administration loans are generally available to independent contractors, small- and mid-size carriers if they have fewer than 500 employees, average annual receipts of less than $30M, or a maximum tangible net worth of $15M or less and average net income of $5M or less for the most recent two fiscal years.To learn more about these options, scroll down or click here.

- The Main Street Lending Program, which was exclusive to larger companies that have between 500 and 10,000 employees, has been terminated, and all loans were finalized as of January 8, 2021.

Tax Relief

Other provisions, like the Employee Retention Tax Credit, are available to eligible employers regardless of size. To learn more about these options, scroll down or click here.

Loans for Independent Contractors, Small- and Mid-Size Carriers

The CARES Act created new and expanded existing federal loan programs tailored to small businesses:

- Paycheck Protection Program

- Economic Injury Disaster Loans

- Emergency Economic Injury Grant

Paycheck Protection Program

The CARES Act established the Paycheck Protection Program to provide eight weeks of cash-flow assistance in 100% federally guaranteed loans to maintain payroll. Loan sizes equal 250% of an employer’s average monthly payroll, with a maximum loan amount of $10 million and a maximum interest rate of 4%. Loan payments will be deferred six months, and the program will be available retroactively from February 15, 2020—enabling employers to rehire any recently laid-off employees through June 30, 2020.

With the enactment of the Paycheck Protection Program Flexibility Act on June 5, 2020, the deadline to rehire workers to Dec. 31 to qualify for loan forgiveness. However, the forgivable amount must be determined without regard to a reduction in the number of employees if the recipient is (1) unable to rehire former employees and is unable to hire similarly qualified employees, or (2) unable to return to the same level of business activity due to compliance with federal requirements or guidance related to COVID-19.

PPP loans are available to independent contractors, small- and mid-size fleets that:

- Have 500 or fewer employees;

- Qualify as a small business concern under existing Small Business Act criteria (which, in the trucking industry, typically means average annual receipts of $30M or less); or

- Have a maximum tangible net worth of $15M or less and average net income of $5M or less for the most recent two fiscal years.

PPP loans can be used to cover costs of:

- Employee salaries and commissions;

- Insurance premiums and other group healthcare benefits during periods of paid sick, medical, or family leave;

- Mortgage interest payments;

- Rent and utilities; and

- Interest on debt obligations that were incurred before the covered period.

60% of the loan amount must be spent on payroll costs to achieve full loan forgiveness. The remaining 40% may be used on other eligible expenses.

Borrowers are eligible for partial loan forgiveness subject to certain conditions. The portion of the loan used during the eight-week period can be forgiven if the employer maintains its number of full-time equivalent employees. Forgiveness of the loan is reduced in proportion to any reduction in FTEs, or if compensation to employees is decreased by more than 25% as compared to a look-back period. You can find the loan forgiveness application here.

ATA's National Accounting Finance Council produced this guide to assist with the PPP application process. You can download the application form here.

Frequently Asked Questions on PPP

Where can I apply?

You can apply through any existing SBA lender or through any federally insured depository institution, federally insured credit union or Farm Credit System institution participating in the program. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program. You should consult with your local lender as to whether it is participating. Visit www.sba.gov for a list of SBA lenders. The application is available here.

How large can my loan be?

Loans can be for up to two months of your average monthly payroll costs from the last year plus an additional 25% of that amount. That amount is subject to a $10 million cap. If you are a seasonal or new business, you will use different applicable time periods for your calculation. Payroll costs will be capped at $100,000 annualized for each employee.

How much of my loan will be forgiven?

You will owe money when your loan is due if you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utilities payments over the 8 weeks after getting the loan. You will also owe money if you do not maintain your staff and payroll.

- Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Level of Payroll: Your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020.

What can I use these loans for?

You should use the proceeds from these loans on your:

- Payroll costs, including benefits;

- interest on mortgage obligations, incurred before February 15, 2020;

- Rent, under lease agreements in force before February 15, 2020; and

- Utilities, for which service began before February 15, 2020.

What counts as payroll costs?

Payroll costs include:

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee)

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit

- State and local taxes assessed on compensation

- For a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee

What is my interest rate?

The rate is 1%.

When do I need to start paying interest on my loan?

Recipients who do not apply for forgiveness or are not entitled to total loan forgiveness shall have 10 months from the program's expiration to begin making payments.

When is my loan due?

The minimum maturity of the payback will now be five years instead of two.

What do I need to certify?

As part of your application, you need to certify in good faith that:

- Current economic uncertainty makes the loan necessary to support your ongoing operations.

- The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.

- You have not and will not receive another loan under this program.

- You will provide to the lender documentation that verifies the number of full-time equivalent employees on payroll and the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the eight weeks after getting this loan.

- Loan forgiveness will be provided for the sum of documented payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.

- All the information you provided in your application and in all supporting documents and forms is true and accurate. Knowingly making a false statement to get a loan under this program is punishable by law.

- You acknowledge that the lender will calculate the eligible loan amount using the tax documents you submitted. You affirm that the tax documents are identical to those you submitted to the IRS.

- You understand, acknowledge, and agree that the lender can share the tax information with the SBA’s authorized representatives, including authorized representatives of the SBA Office of Inspector General, for the purpose of compliance with SBA Loan Program Requirements and all SBA reviews.

Has there been any indication of what a business should do if they are approaching or contemplating bankruptcy and wanting to apply for PPP?

The SBA issued additional guidance on the PPP lending program that specifies that firms that have entered into bankruptcy either at the time of application or at any time before the funds from the PPP loan are distributed would be ineligible for a PPP loan. If a company went into bankruptcy after the company applied for the loan, they would not receive the PPP funding.Will SBA allow companies to return loans without penalty if they find liquidity elsewhere in the market?

The SBA guidance provides a safe harbor for certain businesses to repay their loans by May 7, 2020, to allow them to be deemed to have made their financial need certification in good faith. This is intended to "ensure that borrowers promptly repay PPP loan funds that the borrower obtained based on a misunderstanding or misapplication of the required certification standard."If my business is part of a portfolio company, what does that mean for qualification into PPP?

Portfolio companies are urged to follow the existing SBA affiliation rules and to be mindful of the financial need certification in the PPP loan application.

Disaster Loans and Economic Injury Grants

The long-standing Economic Injury Disaster Loan Program assists businesses, renters and homeowners in areas affected by declared disasters. The CARES Act expands EIDL eligibility to include businesses from all 50 states, the District of Columbia and U.S. territories that have suffered economic harm from COVID-19.

EIDLs offer up to $2 million in assistance and may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses and payments are deferred for one year

Businesses applying for COVID-19 disaster loans can receive expedited access to capital with an Emergency Economic Injury Grant —a $10,000 advance within three days of applying for an EIDL. The advance does not need to be repaid under any circumstance and may be used to keep employees on payroll, to pay for sick leave, meet increased production costs due to supply chain disruptions or pay business obligations, including debts, rent and mortgage payments.

To receive the cash advance, the Emergency Economic Injury Grant can be requested when applying for an EIDL.

To apply, visit SBA's website here.

Tax Provisions for Carriers of Any Size

The following provisions in the CARES Act can apply to employers of all sizes. However, each has its own set of parameters and requirements.

- Employee Retention Tax Credits

- Net Operating Loss Carrybacks

Employee Retention Tax Credits

The CARES Act created the Employee Retention Credit to encourage businesses to keep employees on payroll. The refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19.

Qualifying employers must fall into one of two categories:

- The employer's business is fully or partially suspended by government order due to COVID-19 during the calendar quarter.

- The employer's gross receipts are below 50% of the comparable quarter in 2019. Once the employer's gross receipts go above 80% of a comparable quarter in 2019, they no longer qualify after the end of that quarter.

Wages paid after March 12, 2020, and before Jan. 1, 2021, are eligible for the credit. Wages taken into account are not limited to cash payments and include a portion of the cost of employer provided health care.

Qualifying wages are based on the average number of a business's employees in 2019:

- Employers with less than 100 employees: If the employer had 100 or fewer employees on average in 2019, the credit is based on wages paid to all employees, regardless if they worked or not. If the employees worked full-time and were paid for full-time work, the employer still receives the credit.

- Employers with more than 100 employees: If the employer had more than 100 employees on average in 2019, then the credit is allowed only for wages paid to employees who did not work during the calendar quarter.

The Treasury Department has more information, including on how to receive the credit, here.

Net Operating Loss Carrybacks

Under the CARES Act, net operating losses arising in tax years beginning after December 31, 2017, and before January 1, 2020 (e.g., NOLs incurred in 2018, 2019, or 2020 by a calendar-year taxpayer) may be carried back to each of the five tax years preceding the tax year of such loss.

Since the enactment of the Tax Cuts and Jobs Act of 2017, NOLs generally could not be carried back but could be carried forward indefinitely. Further, the TCJA limited NOL absorption to 80% of taxable income. The CARES Act temporarily removes the 80% limitation, reinstating it for tax years beginning after 2020.

Consult your tax advisor on how this may apply to your business.